s corp dividend tax calculator

Being Taxed as an S-Corp Versus LLC. Person B would receive 15000 in distributions.

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Annual state LLC S-Corp registration fees.

. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations. Unlike partnerships S corporations are not. A tax-free reduction of the shareholders stock basis.

The S corporation will issue a shareholder a Schedule K-1. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Or other income from a trust estate partnership LLC or S corporation.

Unlike a C corporation each year a shareholders stock andor debt basis of an S corporation increases or decreases based upon the S corporations operations. This tax calculator shows these values at the top of your results. However if you elect to be taxed as an S-Corporation and take a 40000 salary with the remaining 30000 being a distribution to you or you keep it in the business you pay only.

Enter the total amount of your salary which has been put. Section 1368 notes the distribution by an S corporation of property or cash may result in three distinct tax consequences to the shareholder receiving the distribution. The biggest difference is the tax rates - instead of the usual 20 40 45 depending on your tax band youll be taxed at 75 325 and 381.

Dividends For S Corp and C Corp Owners Explained Finances and Taxes 1. Above your dividend allowance youll pay tax at the rate you pay your other income - known as your marginal tax rate. For example if your one-person S corporation makes 200000 in profit and a reasonable salary is 80000 you will pay 12240 153 of 80000 in FICA taxes.

In 2022-23 these rates will all increase by 125 percentage points. Normally these taxes are withheld by your employer. Click here to show how weve calculated your taxes.

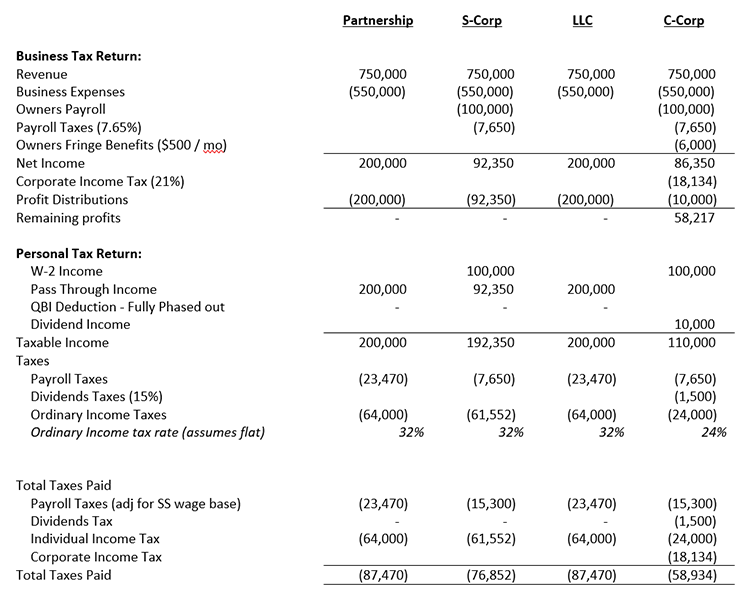

S Corp Tax Calculator - S Corp vs LLC Savings. Electing S corp status allows LLC owners to be taxed as employees of the business. S corps are not taxed at the business level so there is no double taxation as in a C corporation.

Dividends are taxed at a lower rate than income. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. Tax calculator based on 2018 Tax Law.

The selling of the stock may result in capital gains. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. How S Corporations Help Save Money.

The amount of a shareholders stock and debt basis in the S corporation is very important. What percent of equity do you own. If youre a basic-rate payer youll pay 75 on dividend income.

To use our calculator simply. The tax rate on nonqualified dividends is the same as your regular income tax bracket. 2022-02-23 As a pass-through entity S corporations distribute their earnings through the payment of dividends to shareholders which are only taxed at the shareholder level.

If youre new to personal taxes 153 sounds like a lot less than the top bracket of 37. How much can I save. This calculator has been updated for the 2022-23 tax year.

Income Tax Calculator. I created this S corp tax savings calculator to give you a place to start. Enter the salary you would pay yourself if an S-Corporation.

Profitsdividends paid to you. Estimated Local Business tax. Use this payroll tax savings calculator to figure out if an S corp really is the best business entity for you.

It lets you write off your salary which lowers your payroll taxes. This offers you an estimate for your business net income for the year to use in our S Corp tax savings calculator. But if the income is long-term capital gains or qualified dividends you pay the lower preferential tax rates sometimes 0 usually 15 and worst-case 20.

For example if you pay out 50000 in distributions and person A owns 50 percent of the S Corporation person B owns 30 percent and person C owns 20 percent. Total first year cost of. Annual cost of administering a payroll.

A sole proprietorship automatically exists whenever you are engaging in business by and for yourself without the protection of an LLC Corporation or Limited Partnership. 50000 of ordinary business profits. With the use of our Dividend Tax Calculator you are able to discover how much income tax you will be paying with the input of your current salary and the annual dividend payments that you make.

This may potentially reduce your total annual tax liability. With Social Security at 124 and Medicare at 29 Self-Employment is a major cost of 153 right off the top before theres any income taxes paid. In an S corp business owners are salaried.

If the income is ordinary income you pay the ordinary income tax rates. Say for example that you get 125000 of income from an S corporation. If the income is considered capital gains or dividends you would pay a lower tax rate ranging from 0 percent to 20 percent.

Person C would receive 10000 in distributions. If an S corp allocates 125000 profit to you the shareholder the character of such income is important. Tax on dividends is calculated pretty much the same way as tax on any other income.

An S corporation S corp is a tax structure under Subchapter S of the IRS Internal Revenue Service for federal state and local income tax purposes that is elected by either an LLC or a corporation. Its also possible you get a Schedule K-1 if you invest in a fund or exchange-traded fund ETF ETF that operates as a. Higher-rate payers pay 325 while additional-rate payers pay 381.

Income is taxed only once when the income is earned by the S corporation whether the income is reinvested or distributed. Overhead include yours and others salaries but not FICA tax Salary Paid to You. How your dividend tax is calculated.

If income is standard income you would pay the standard income tax rates. Our S corp tax calculator will estimate whether electing an S corp will result in a tax. Person A would receive 25000 in distributions.

Enter the estimated yearly net income for the business. Any remaining business profits are distributed to owners as dividends. Dividend Tax Rates for the 2021 Tax Year.

The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800. This allows owners to pay less in self-employment taxes and contribute pre-tax dollars to 401k and health insurance premiums.

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Taxation In An S Corporation Distributions Vs Owner S Compensation Youtube

S Corp Income Tax Rate What Is The S Corp Tax Rate

Demystifying Irc Section 965 Math The Cpa Journal

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

Llc Tax Calculator Definitive Small Business Tax Estimator

How Are Dividends Taxed Overview 2021 Tax Rates Examples

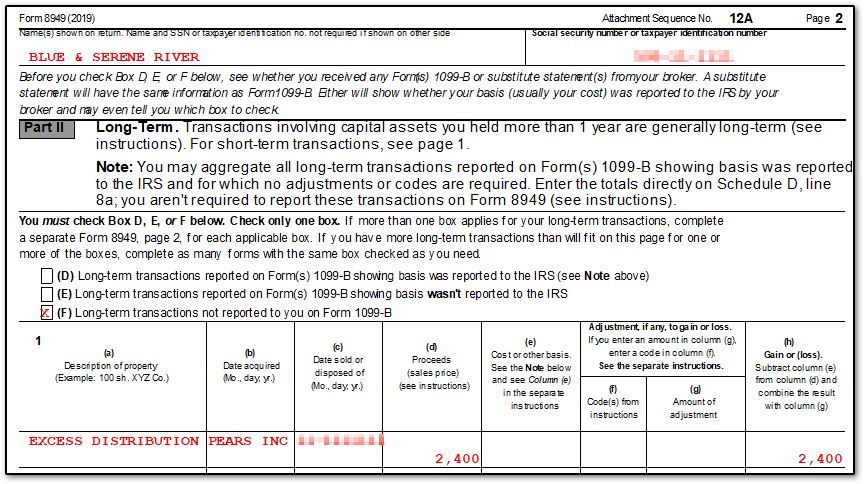

1040 Distributions In Excess Of Basis From 1120s

S Corporation Shareholders And Taxes Nolo

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

S Corp Vs Llc Difference Between Llc And S Corp Truic

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

S Corp Vs Llc Difference Between Llc And S Corp Truic

Oh How The Tables May Turn C To S Conversion Considerations Stout

Llc Tax Calculator Definitive Small Business Tax Estimator

Oh How The Tables May Turn C To S Conversion Considerations Stout